While we work hard to provide accurate and up to date information that we think you will find relevant, Forbes Advisor does not and cannot guarantee that any information provided is complete and makes no representations or warranties in connection thereto, nor to the accuracy or applicability thereof. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Forbes Advisor. Second, we also include links to advertisers’ offers in some of our articles these “affiliate links” may generate income for our site when you click on them. This site does not include all companies or products available within the market. BACKGROUND The FTT Act essentially replicates the Spanish Government's proposal sent to Parliament in February 2020. It will enter into force on 16 January 2021. The compensation we receive for those placements affects how and where advertisers’ offers appear on the site. The Spanish Parliament has approved Act 5/2020, of 15 October, on the Financial Transactions Tax (the 'FTT Act'). First, we provide paid placements to advertisers to present their offers.

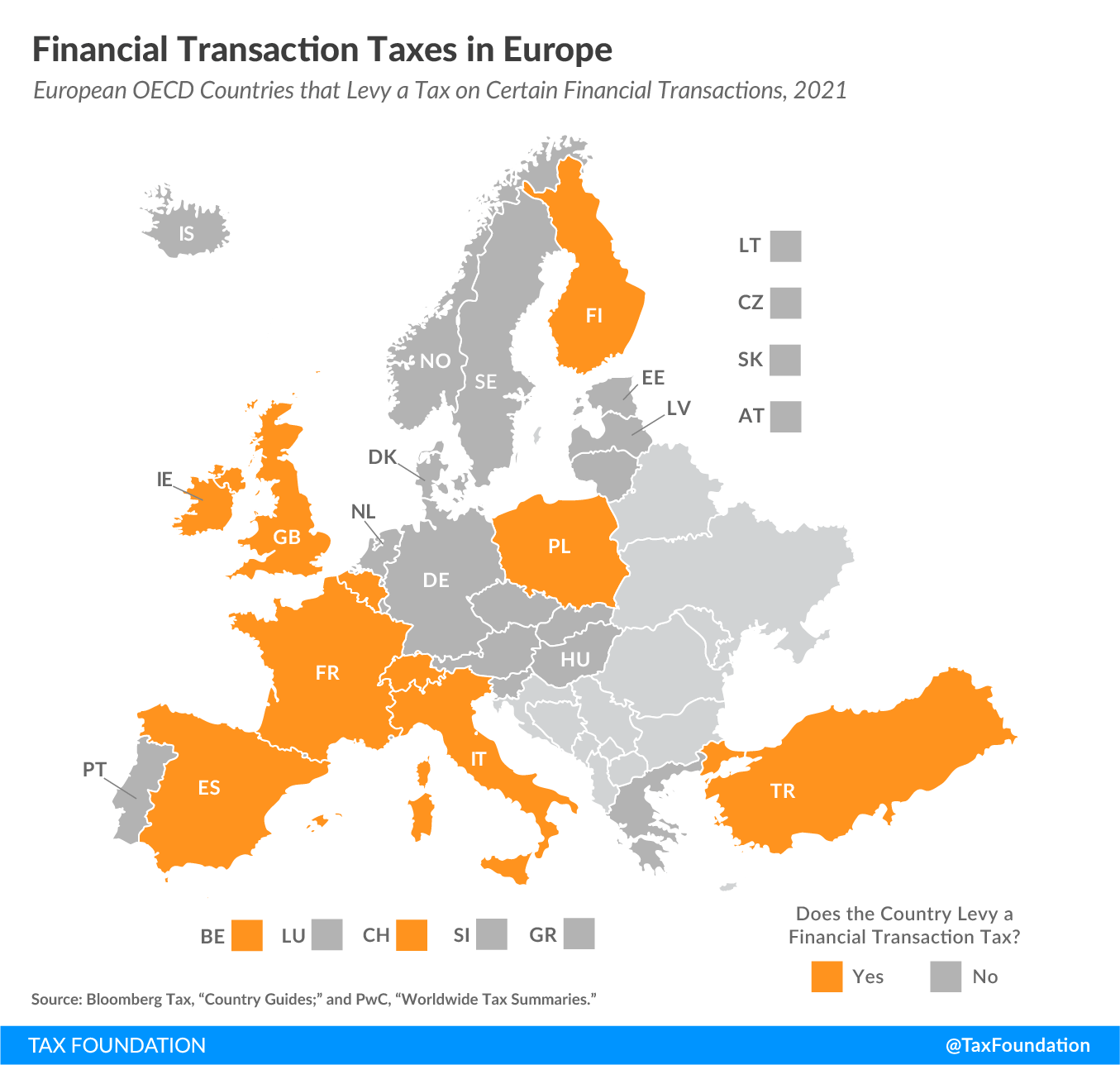

An update on the VAT treatment of staff secondments. The implementation of the Digital Services Tax in the UK and the exemption applicable to the Financial Services. The Spanish FTT is an indirect tax on acquisitions of the shares of large listed Spanish companies, which applies independent of the residence of the purchaser participating in the transaction or the place where the acquisition takes place. This compensation comes from two main sources. An overview of the Spanish Financial Transaction Tax Bill including practical aspects around its implementation.

#Spanish financial transaction tax for free#

To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive compensation from the companies that advertise on the Forbes Advisor site.

The Forbes Advisor editorial team is independent and objective.

0 kommentar(er)

0 kommentar(er)